Cross-border payments represent one-sixth of total transaction values, its revenues total up to $200 billion globally ( Mckinsey Report ). This is split roughly evenly between transaction fees and foreign exchange (FX) revenues. This equates to 27 percent of global transaction revenues and is increasing by 6 percent annually. Currently cross-border payments are still slow and has a hefty transaction fees. Try out this Western Union price estimator. To send 100 dollars from the US to Taiwan would take 4 business days and 15 dollars in transaction fee. In this blog post, I will try to give a high-level intro to how cross-border payment system works.

What is Cross-Border Payments

Cross-border payments occur when an end party in one country pays an end party in another country. In order to complete cross-border payment, you need to go through compliance check (KYC, AML), currency conversion and payment processing ( clearing and settlement ). These are extensively explained in this blog post.

What Happens Under the Hood

At its core, a payment transaction is about sending money from point A to point B or from person A to person B.

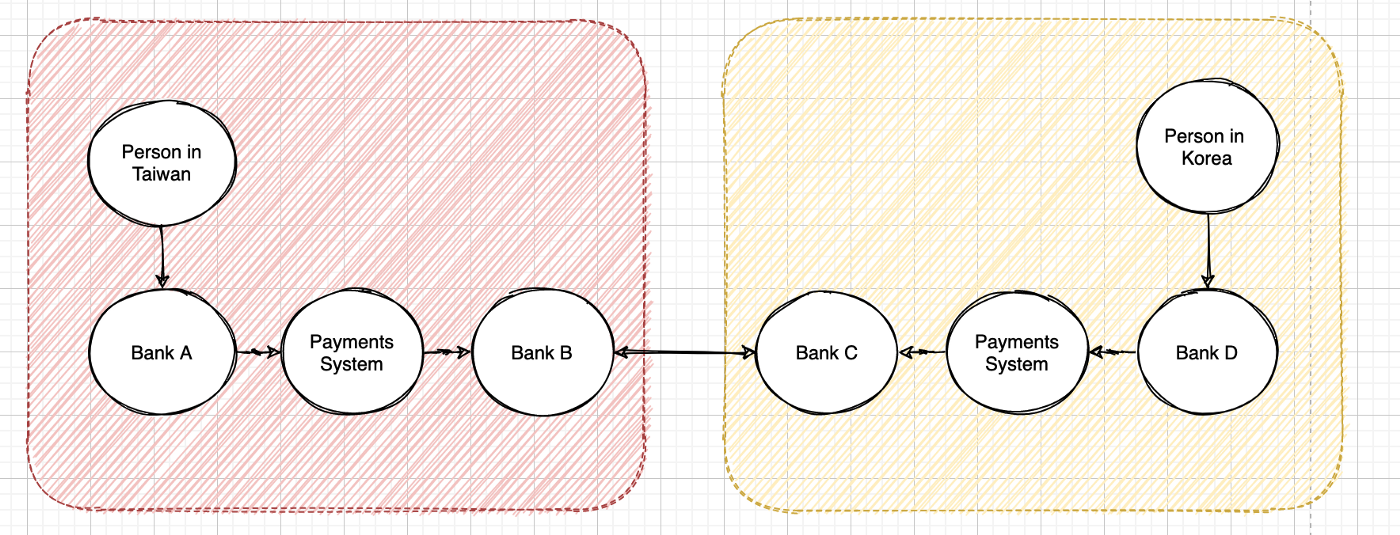

However things get slightly more complicated when doing cross-border payments. Payment systems operate on an in-country basis: only banks that are chartered or licensed to operate in a country may join a payments system in that country ( How to Start a Bank ).

Because of this, transferring money between countries often require two separate transactions, one in the sending country and one in the receiving country. The two transactions are settled among the banks via a complex web of correspondent banking accounts ( also known as Nostro accounts ) that banks have with each other. These accounts may be housed in the sending country, the receiving country, or a third country.

Bank B is the correspondent bank of Bank A. Bank C is the correspondent bank of Bank D.

To give an example, a Taiwanese company making a U.S. dollar payment to a Korean company notifies Bank A that it wants to make an international dollar transfer. Bank A sends a notice to Bank B ( correspondent bank ) via the SWIFT system ( will talk about this later ). Bank B then settles with Bank C ( correspondent bank for the Korean company ). This post has a great explanation of interbank payments.

To conclude, the global payment network is a combination of country-specific payment systems to create the effect of a global payment system. There are multiple payment systems introduced to solve dual-system complexity, such as the Federal Reserve Global ACH service and the SEPA (Single Euro Payments Area) payments systems.

What is the Infrastructure of International Payments

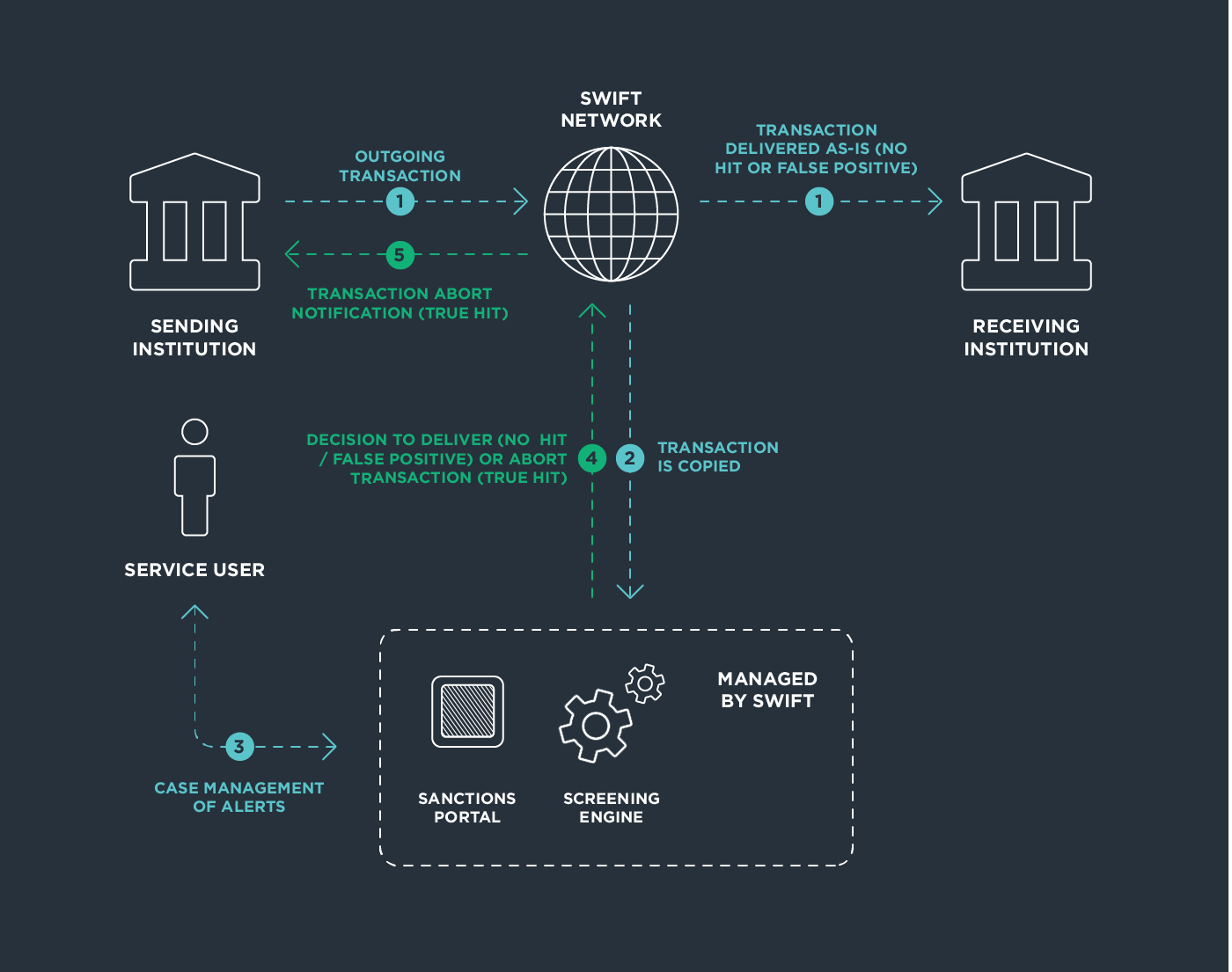

Source: https://fin.plaid.com/articles/what-is-swift/ Most international wire transfers happen when two banks don’t have an established financial relationship. Hence these wire transfers are executed through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network. Knowing there is not a working relationship with the destination bank, the originating bank can search the SWIFT network for a correspondent bank that has arrangements with both banks. Upon finding a correspondent bank having arrangements with both sides of the transfer, the originating bank sends the transferred funds to its Nostro account held at the correspondent bank.

Using the example above, the correspondent bank deducts its transfer fee, usually $25 to $75, and transfers the funds to the receiving bank in Japan. In transactions such as this, the correspondent bank adds value in two ways. It alleviates the need for the domestic bank to establish a physical presence abroad and saves the work of setting up direct arrangements with other financial institutions around the world. (reference: https://www.investopedia.com/terms/c/correspondent-bank.asp)

It is important to note that SWIFT doesn’t carry out the actually transfer of value. Swift is the messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes. SWIFT sends payment orders between institutions’ accounts, using SWIFT codes. It was SWIFT that standardized IBAN (International Bank Account Numbers) and BIC (Bank Identifier Codes) formats. SWIFT owns and administers the BIC system, meaning that it can quickly identify a bank and send a payment there securely.

International Transfers are ultimately settled by central banks. The correspondent banks will settle using the local Real Time Gross Settlement system. This is a great post on how this works.

However, cross-border payments have multiple factors effecting its cost and time. There are foreign exchange cost and as the payment passes through each correspondent bank, the fees stack up and execution time also increases.

What is the future of cross-border payments

There are a couple companies ( Ripple, R3, Stellar ) trying to use blockchain technology to make cross-border payments simpler by processing cross-border payments in real-time with end-to-end tracking. If you want to learn more you can visit Stellar’s developer guide or the blog by Richard Brown ( CTO of R3 ). I recommend you start with this post by Richard ( A simple explanation of how money moves around the banking system ).

Reference:

Payment Systems in the US — Hight recommend reading this book. Clear explanation of the payment landscape.

Resources on cross-border payments:

https://fin.plaid.com/articles/a-roadmap-to-frictionless-cross-border-payments/

https://www.r3.com/wpcontent/uploads/2018/05/CrossBorder_Settlement_Central_Bank_Money_R3-1.pdf

Resources on Correspondant Banks:

https://bitsonblocks.net/2017/09/04/a-gentle-introduction-to-interbank-payment-systems/

http://essay.utwente.nl/78027/1/Ginneken_MA_BMS.pdf